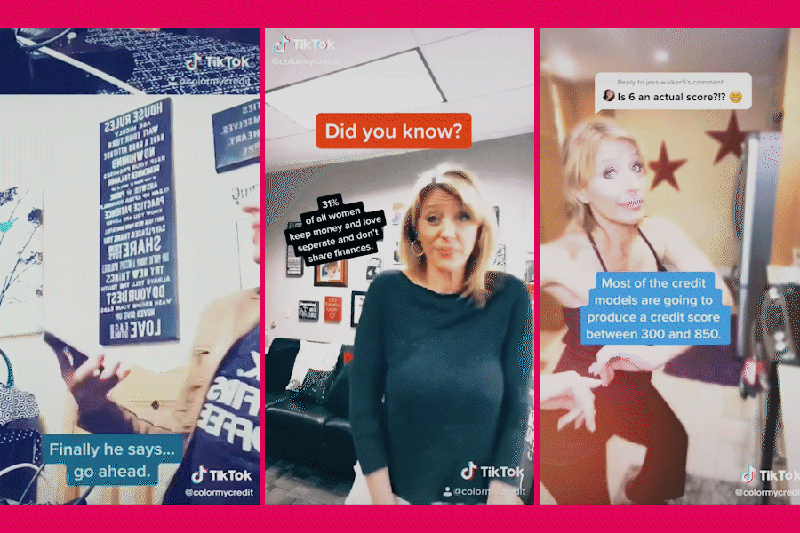

Meet the TikTok Influencer Whose Viral Videos Are Helping Gen Z Boost Its Credit

In her first-ever viral TikTok, mortgage lender Alisa Glutz pretends to call a collection company to negotiate a debt.

She’ll pay the balance that day, she says in the scripted video, if the company agrees to delete it from her record. (Fewer collection accounts on your credit report improves your overall credit score.)

One year later, the 43-year-old Arizona-based influencer has more than 400,000 followers on the short-form video platform, where she shares multiple posts a day aimed at helping people boost their credit scores, one point at a time.

“It’s almost like I’m a big sister who comes alongside you and coaches you,” she says. “This is what I’d say and do in your situation.”

Glutz, who’s worked as a mortgage lender for 20 years, created a TikTok account in December 2019.

On Instagram, where Glutz has 10,000 followers, you’re limited to a snapshot and a caption. On TikTok, you can show viewers through how to do something from start to finish — usually in bite-size 15- to 60-second clips. Add a Top 40 song in the background, and suddenly it doesn’t feel like personal finance advice at all.

That’s particularly attractive for Gen-Z users; TikTok’s primary user base.

“Most high schools don’t teach personal finance, but all these teenagers are on TikTok,” Glutz says. “It’s a great way to get in front of these students who will soon need these life skills.”

Glutz gets most of her TikTok ideas from her follower’s questions, but her tips are based on principles from her 2016 book, Color My Credit, a guide that breaks down concepts like how to interpret a credit report and pay off debts that will hurt your score the most into simple, actionable tips.

“I want to show people that building a financial legacy is easier than they think,” she says. “Anyone who knows how to color can build great credit.”

Here are some of Glutz’s best credit explainers — for Gen Y and beyond.

Why do I have so many different credit scores?

You've probably noticed that the three major credit bureaus—Equifax, TransUnion, and Experian—often assign you three different FICO scores. Glutz says credit card companies can choose which of those companies to report to (some report to all; others report to just one) so it’s common for those scores to fluctuate between bureaus.

Most lenders average the three scores to determine borrowing limits and interest rates.

The best way to get an accurate snapshot is by going to MyFico.com, she says. You’ll have to pay around $30, but you’ll be able to see industry-specific information (like the likelihood that you'll get approved for an auto loan) to get a feel for where you stand.

Should I sign up for Credit Karma? It’s free!

Sites like Credit Karma give you free access to your credit score, and in exchange, you give them permission to share your data with third party companies. Lots of apps operate this way (including TikTok), but Credit Karma is unique in that it has access to data from your credit report specifically.

One thing Glutz likes about Credit Karma is that it lists the dates your credit card info is reported to credit bureaus, which makes it easy to chart out a month-to-month plan for paying down your card before the credit card company report it.

But Credit Karma also shows you a bunch of scores that usually don’t have anything to do with your situation, she adds. Like your Vantage score: A number Glutz says basically no lender actually cares about.

Is it bad to constantly check my credit score?

Checking your own credit is called a “soft inquiry,” and doesn’t affect your score.

You can actually pull your own credit score up to 50 times a day with no impact, Glutz says. It’s “hard inquiries,” like the ones landlords make when you apply for an apartment, or the bank makes when you apply for a mortgage, that negatively impact your score. But unless you’re applying for multiple loans (or multiple apartments) at the same time, don’t sweat it too much, Glutz says. Even “hard inquiries” only affect around 10% of your total credit score.

How close to my credit card limit can I get?

Every credit card comes with a built-in credit limit (essentially, how much money the bank feels comfortable loaning you). But if you want an excellent credit score, you’ll want to keep your spending south of that number.

How far south? Since credit bureaus score you on a balance-to-limit ratio, Glutz suggests creating a financial buffer by dropping the last digit from whatever your card-issued limit is. So if your card allows you $10,000, never carry more than a $1,000 balance into a new billing cycle, she says.

Can I “trick the system” by making two credit card payments in a month?

One of the most common credit myths Glutz likes to dispel is that people can hike their credit scores by making two credit card payments in the same billing cycle.

Your credit score, she says, has very little to do with the frequency of your payments (as long as they’re not past-due). It’s all about credit balance and limit.

“Making two payments if you have a high balance can help you pay a card down faster, but it doesn’t have anything to do with the scoring algorithm,” Glutz says.

The majority of credit card companies only report payments to credit bureaus once a month, she explains. Chase is the exception: If you have a Chase credit card, it will automatically report when you pay your balance to zero. So if you have a Chase card and you pay it to zero after making your minimum monthly payment, your score might improve faster than with other cards.

How do I get a higher limit?

Again, balance-to-limit ratio is important. If you’ve got a $1,000 limit on a credit card, your credit score will automatically improve if the company raises that limit to $1,500 — as long as you don’t use the card to rack up a bigger balance.

If you’re in good standing (read: you pay your bill on time every month), most credit card companies will give you a limit increase if you ask, Glutz says. Just call the company, mention you’ve always paid your bill on time, and ask if you can raise your limit.

For some credit cards, you can even request a higher limit online.

This story has been updated with additional information on Credit Karma's privacy policy, as per a company spokesperson.

More From Money:

7 Missed Bills and What They Do To Your Credit Score

Here's Why it Pays to Have a Good Credit Score (Even if You're Not Buying a House)

Check Your Credit Score Right Now — It's Probably Better Than You Think