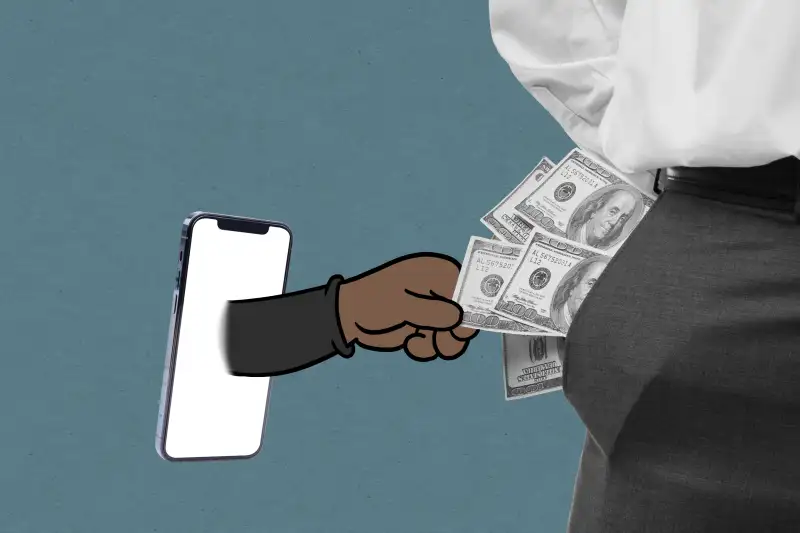

Cash-Advance Apps Court Users With Cute Mascots and Fast Payments — but Beware of the High Costs

Download the Dave app on your smartphone, as millions of people already have, and you’ll be greeted by an anthropomorphic bear wearing thick-rimmed glasses and holding a pawful of cash.

The friendly, upright ursid wants to help you get your finances on track. To do so, the digital financial services app will let you take out a cash advance of up to $250 with no interest. Asterisk. You’ll avoid overdraft fees. Asterisk. And get paid up to two days sooner. Asterisk.

Dave, founded in 2017 and backed by celebrity entrepreneur Mark Cuban, is expected to go public this quarter. It’s one of several fintech startups that offer “interest-free” cash advances, though the companies do make money through a combination of fees, tips or both, hence all the asterisks. The financial apps Earnin and Brigit work similarly, sans the animal mascots. The companies say they’re ushering in the end of predatory payday loans and overdraft fees, and they’ve been gaining popularity throughout the pandemic as cash-strapped users seek out fast funds.

However, consumer experts warn their fees are just as bad as — if not worse than — traditional payday loan APRs, with rates that can easily top 300%. And, they say, the apps can actually trigger overdraft fees. Policymakers are caught in the middle, mulling over how exactly to regulate them. They’re taking a hands-off approach — at least for now.

Dave's cash-advance service is just one of the app's many financial features. The app itself is available for free. But the cash advance portion requires a membership fee of $1 per month, which the company says goes toward linking your bank account.

Once you take out a cash advance, the app prompts you to leave a tip, saying that Dave donates tip money to feed families in need. The recommended tipping amounts default to percentages — 5%, 10% or 15%. (“Tips are completely voluntary,” says Dave spokesperson Danny O’Keefe.)

Yet the techniques Dave and similar companies use to present their voluntary-tipping features are also raising red flags with consumer advocates.

“Some of these applications use some behavioral marketing to incentivize people to pay more,” says Charla Rios, a small-dollar loan researcher at the Center for Responsible Lending. “The more you tip, the happier the cartoon bear is, and that kind of thing.”

With Dave, you can set custom tipping amounts on a scale of 0% to 25% in the settings menu, except the percentages in this menu are now referred to as “healthy meals.” As you increase your tip, you’ll see a young animated girl in a bear shirt grow excited as she’s surrounded by fruit, veggies and bread. Move the tip all the way to zero, and all you’ll see is an empty plate.

O’Keefe confirmed that a portion of tips — not the whole sum — goes to Dave’s non-profit partner Feeding America. The company has provided about 31 million meals through the partnership and made more than $5 million in total charitable contributions, he says.

In Earnin’s case, there’s no monthly membership fee. If you take out a cash advance (of up to $500), the app prompts you to “pay it forward” by associating its tips with helping other Earnin users, who are represented by cutesy avatars of ninjas and astronauts. A $5 tip will help one user, the app says. A $10 tip will help two users, and so on.

It’s possible to skirt tipping altogether, but only if you know to tap “custom tip” and manually change the tipping dial to zero. According to the New York Post, not tipping previously had consequences: Earnin used to limit the amount of cash advances to New York users who did not tip. The company reportedly halted the “pay-to-play” practice in New York in 2019 under regulatory pressure.

In a statement to Money, Earnin wrote that tipping behavior and history are not used as criteria to determine cash-advance availability or amounts. The company did not elaborate on when or where the practice, as described by the Post, was in effect.

The Brigit app, on the other hand, doesn’t rely on the tip-based model. Instead, it charges users a $9.99 monthly membership fee to become eligible for a cash advance of up to $250 — as well as a host of other budgeting and credit score tracking features. The monthly fee applies regardless of whether users take out an advance or not. Brigit did not respond to Money’s request for comment.

A regulatory battle over the definition of ‘credit’

Consumer advocates say that apps like Dave and Earnin point to the voluntary nature of their tipping and fee structures to avoid being classified as credit products. That allows them to play by different rules than traditional creditors.

But regulatory guidance on newer fintech companies that offer cash advances and similar products has been somewhat mixed. As it stands, consumers currently don’t receive the same federal protections for a cash advance from a company like Earnin as they would for a cash advance or loan from a more traditional lender — from, say, a credit card company like Chase or even a payday lender like Amscot.

So how are they regulated? “That’s a good question,” says Lauren Saunders, an associate director at the National Consumer Law Center (NCLC). “They’re not, really.”

That’s because, in late 2020, the Consumer Financial Protection Bureau (CFPB) issued advisory guidance, concluding that payday advances from fintech companies generally aren’t considered credit, as defined by federal law. Therefore, the fintech lenders aren’t required to disclose the fees associated with advances in terms of APRs, or annual percentage rates.

The focus of the CFPB’s guidance was mostly on payroll advance services through companies like PayActiv. Such companies market themselves as an employee perk by partnering directly with employers, as opposed to the apps that are marketed directly to consumers.

All of these companies loosely fit under the umbrella of earned wage access, early wage advances or payday advances. (They go by many names.) Consumer advocates break them into two core categories: The employer-partnership model — the PayActivs — and the direct-to-consumer model — the Daves.

While consumer advocates do have a bone to pick with the employer-partnership model, they stress that the CFPB’s guidance for that model has a rippling effect on the far riskier direct-to-consumer apps.

The Center for Responsible Lending (CRL), the NCLC and 94 other consumer, faith and labor organizations wrote a letter to the CFPB in October, asking the agency to rescind its opinions and regulate fintech payday products as credit. Lobbyists for the fintech lending industry, the organizations wrote, are using the CFPB's actions to argue for further exemptions from state lending laws.

While federal regulators have so far gone the laissez-faire route, state regulators are also grappling with the same questions.

The New York Department of Financial Services, in tandem with 10 other states and Puerto Rico, launched an ongoing investigation to determine if fintech lenders are skirting state lending rules. Some of the firms appear to collect “usurious” interest rates in “the guise of ‘tips’” or monthly membership fees, the DFS said in announcing the investigation in 2019.

On the other side of the country, California’s Department of Financial Protections and Innovation signed an agreement earlier this year with Earnin and four similar fintechs, exempting them from state APR disclosure requirements for now. In the meantime, the agency is collecting and analyzing quarterly reports from the companies to determine the “risk and benefits to California consumers.”

Congress is also entering the fray to determine how such companies should be regulated, if at all. The U.S. House Committee on Financial Services held a hearing in November to investigate the risks and benefits of fintech companies that offer cash advances and similar credit-like products.

“Shiny fintech garb does not remove the need for basic consumer protections,” Saunders, of the NCLC, testified at the hearing. “Earned wage access products are a form of payday loan — wage advances repaid on payday — and should be regulated as credit.”

Fees and tips — or sky-high loan APRs?

When you order lunch through Uber, a nearby food courier scrambles to grab your food and deliver it to your doorstep. After you place your order, Uber prompts you to leave a tip of 15% or 20%, which you can change depending on how good a job you think the courier did.

Apps like Dave and Earnin prompt you to tip in very similar ways. On the user side, whether it’s Uber or Earnin, it’s just a quick couple taps on your smartphone all the same. But Saunders says consumers should view the tips on cash advances very differently.

“The tip isn't going to a human being who gave you a service," she says. “It's going to a big company that's making money and is just using tips as a form of interest.”

Money lending is typically viewed in terms of APRs so consumers can compare products with different fees or interest rates in a standardized way.

But “the tips model can really add up in ways that are not apparent,” Saunders says.

Take, for instance, the 10% or 15% tips suggested by cash-advance apps. Those are simple percentages that don’t factor in time like APR does. Viewed through the lens of APR, those voluntary tips and fees could easily translate into three-digit APRs.

“Default tips on most of these apps are equivalent to interest rates that can be 200% or 300% APR or higher,” Saunders says.

For example, if you tip 15% on a $100 advance that you use to tide you over for two weeks until your next payday, that would equate to an APR of 391%. And that’s not including all of the other fees that could apply.

For instance, a cash advance through both Dave or Earnin may take several business days to hit your bank account by default. To expedite your advance, they charge you extra: Dave’s fees range from $1.99 to $5.99, depending on the advanced amount ($5.99 for an advance of $100 or more), and Earnin charges a flat “Lightning Speed” fee of $2.99, no matter the amount. (According to Earnin, the fee is voluntary, part of a “small test” and not available to all Earnin users. The company will refund it if the advance doesn’t transfer on time.)

A 14-day, $100 immediate cash advance through Dave — including its $1 membership fee and a 15% tip — would translate into an APR of over 573% if the apps were subject to the same rules as other payday lending products. According to state-by-state rules from the Consumer Federation of America, a 573% APR for a $100, 14-day loan from a traditional payday lender would violate lending laws in more than 30 states.

“That is an example of why it should be a regulated product, because it is a form of credit at this point,” says Rios of CRL.

Rios also warns of additional fees, beyond the sky-high APRs, associated with cash-advance apps. For example, despite their marketing as overdraft avoidance tools, the apps may actually trigger overdraft fees from your bank. That’s because when the time comes to pay back your advance, the lending apps may automatically deduct the funds from your bank account — regardless of whether enough funds are available.

Following a class action lawsuit settled in March, Earnin was ordered to pay $3 million to users who were charged overdraft fees. Earnin denied any wrongdoing in the settlement.

“If we trigger an overdraft due to an error on our part, Earnin will cover the fee,” the company wrote in its statement to Money.

Consumer advocates, including Rios and Saunders, stress that app-based cash advances should be used only as a last resort, and preferably not at all. They’re calling for stronger consumer protection rules to help keep everyday borrowers from racking up unexpected fees and paying three-digit APRs.

Saunders says that there is “a lot of interest” from lawmakers and regulators regarding this new breed of fintech lenders, pointing to the multi-state investigation led by New York’s financial regulators as well as the recent House committee hearing. However, neither have led to clear next steps in terms of policy change.

For now, she says, the ball is in the CFPB’s court.

More From Money:

Best Money Moves for December 2021